Taiwan Company Incorporation

A foreigner wishes to establish an enterprise in Taiwan or to participate in the management of a existing Taiwan corporation, the first thing is to get the approval from the Taiwan investment Commission, MOEA (Ministry of Economic Affairs). When obtaing the approval of MOEA, it will enter into the process of the company registration or formation.

Currently, most of industries in Taiwan are allowed to be invested by the foreigners, but there are few business or industries that are prohibited from holding or investing by the foreigners. The basic principals for the prohibited industries are stated as below:

- 1.Which may negatively affect national security, social safety, good customs and practices, or national health; and

- 2.which are prohibited by the law.

If the investor is Chinese or the capital sourced from China, the allowed invested industries and application procedures are different with the general foreigners due to special relationships between Taiwan and China. You can contact us to get the further information.

(1) Legal forms for foreign investors

The foreign investors could incorporate a propritorship entiry, partnership or company in Taiwan. The regulation and responsibility among to One-man business, Partnership and the Company is different, we summarized the simple comparison for your reference as below:

|

Business Type Item

|

Taiwan Company

|

Sole Propritor or

Partnerships

|

|

Capital Requirement

|

Not Required

|

Not Required

|

|

Liability

|

Liable to the extent of their contribution to the company.

|

Liable for any liabilities arising from the business operation.

|

|

Company Name

|

Approved by the Ministry of Economic Affairs.

|

Approved by the local city or county government.

|

|

Being a juristic person

|

Qualified

|

disqualified

|

|

Bookkeeping

|

Must

|

Must

|

|

Income Tax Rate

|

20% Corporate Income Tax

|

5%-40% Personal Income Tax

|

(2) Company types in Taiwan for the foreign investor

Regarding to the form of company entity, there are three types. It's Taiwan limited company, Taiwan branch or Taiwan representative office.

The comparision of the right and liability are stated as following:

| Business Type Item |

Taiwan Company | Taiwan Branch | Taiwan Office |

| Business Activity | Trading, sales or manufacturing | Trading, sales or manufacturing |

Sales function are not allowed

|

| Income Tax Rate | 20% | Same as a Company | Not applicable |

| Profit Remittance Tax | Withholding tax of 21% | Not applicable | Not applicable |

| Tax Incentives | Applicable | Not applicable | Not applicable |

| Shareholders' Liability | Liable for the extent of capital contribution | Foreign head office is liable for any liabilities unsettled by the branch. | Not applicable |

| Minimum Shareholder Number |

Must have at least 1 corporate shareholder or 2 individual shareholders.

|

Not Required | Not Required |

| Minimum Director Number |

Must have at least 2 directors (between 1 and 3 in the case of a public share company)

|

Not Required | Not Required |

| Minimum Supervisor Number |

Must have at least 1 supervisor (no requirement in the case of a private limited liability company)

|

Not Required | Not Required |

| Minimum Capital Requirement |

No minimum requirement

|

No minimum requirement

|

Not Required |

| Sources of Capital Contribution |

Cash or in kind with the property, patent or goodwill.

|

Cash

|

Not applicable |

| Tax rate impose to the undistributed profit | 5% | Not applicable | Not applicable |

| Annual Tax Return | Required | Required | Not applicable (It's required if you withheld the Income tax ) |

| Withholding Tax impose for some services or expenses | Required | Required | Required |

| Allocation of Administration Expense by the Parent Company |

Subject to a 20% withholding tax rate.

|

Normally not subject to 20% withholding tax rate and can be treated as a tax-deductible item if certain criteria are met.

|

Not applicable |

| Accounting Records | Required | Required | Required |

| Liquidation/dissolution | Required | Required | Not applicable |

| Purchase of Real Estates or Automobiles in the name of the company/ branch/office | Permitted | Permitted | Not permitted |

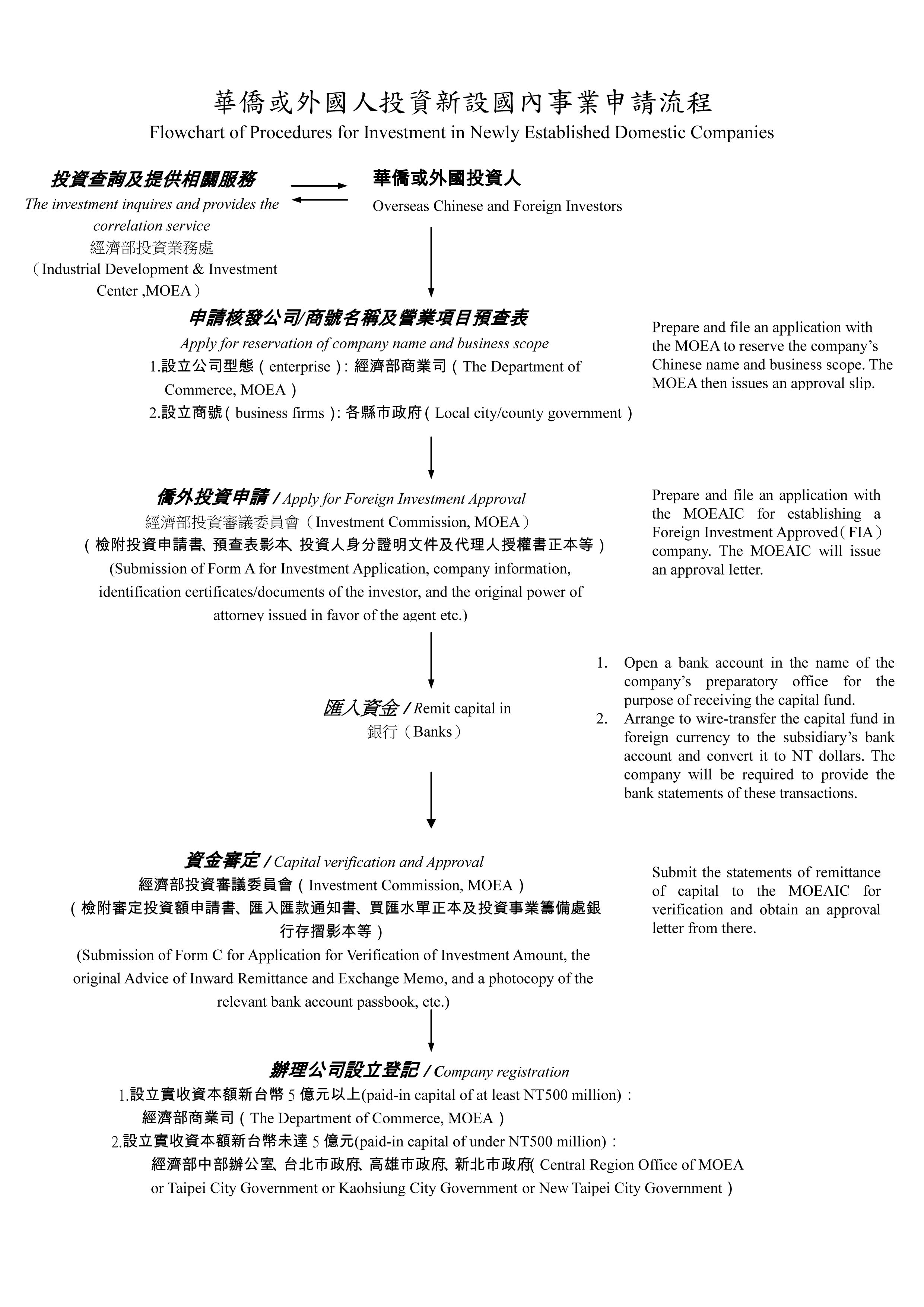

(3) Flowchart of procedure for Invest in Taiwan